Fail to Remit Payroll Tax? Criminal Liabilities May Attach

Normally, whenever an employer fails to pay over payroll taxes collected from its employees, the IRS will impose a hefty Trust Fund Recovery Penalty, which may equal the amount of the unremitted tax. This is usually handled as a civil matter. However, the IRS is increasingly handling these cases as a criminal matter and prosecuting these employers who have fallen behind.

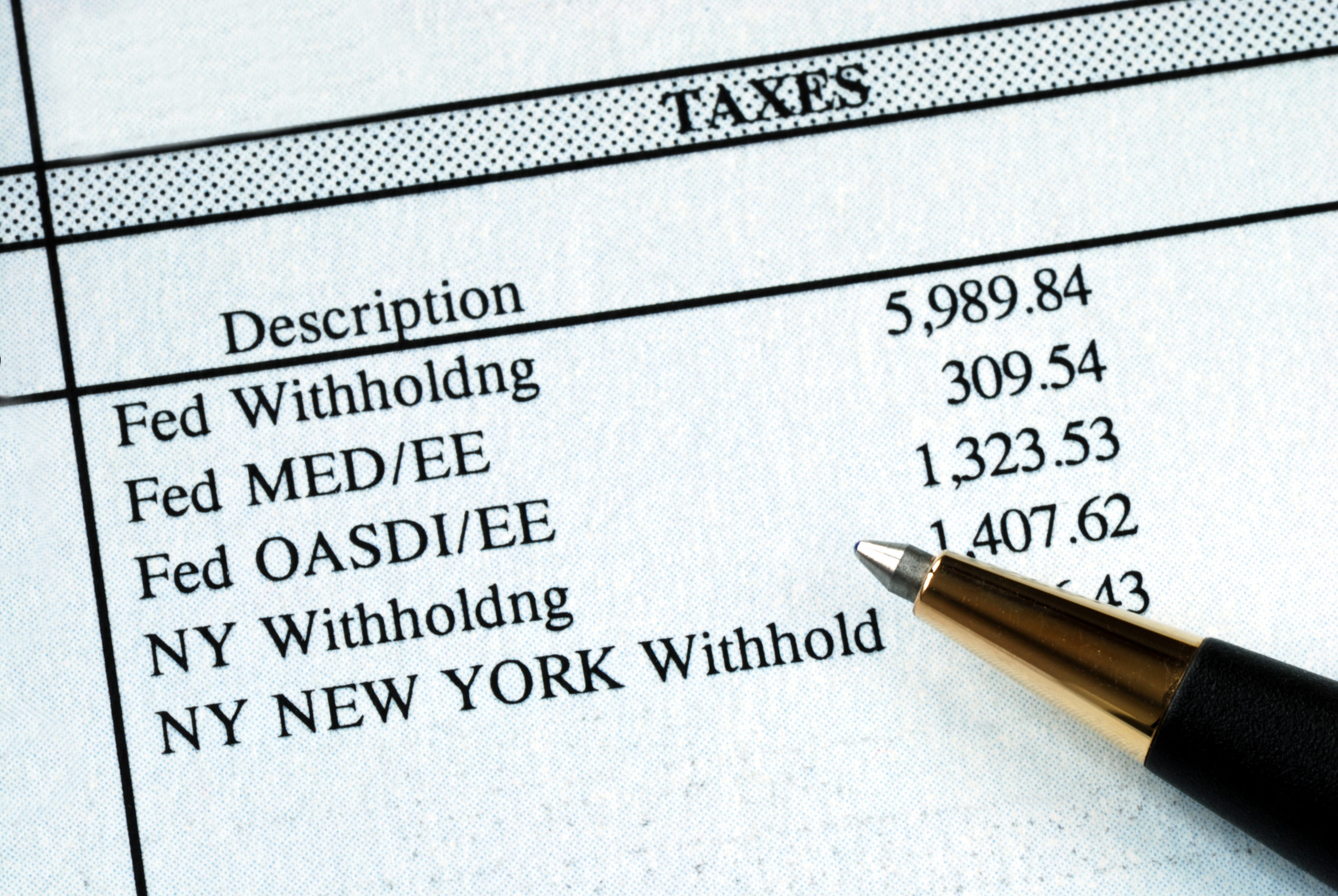

Payroll tax collections make up more than 70% of all taxes collected by the government. Accordingly, taxes collected by employers from employee paychecks and remitted to the government are critical to the ability of the government to function. Consequently, the IRS has made payroll tax enforcement a priority. Yet payroll taxes are probably the number one reason why small businesses get into tax trouble.

For many small businesses, the employee portion of payroll taxes—i.e. the workers wages—is used by the employer to carry the business during hard times. With practically unfettered access to the withheld taxes, employers dip into these funds and struggle when it is time to pay it back. The penalties and interests that are tagged onto the unremitted taxes help in no small way to make it difficult to promptly make it back. In many cases, by the time the IRS catches onto the issue and shows up, the liability has accumulated to such an extent that the business will often never be able to repay the debt in full.

Until recently, the IRS have generally pursued unpaid payroll liabilities through civil enforcement against the company and by assessing the responsible individuals for the unpaid portion of the taxes that was withheld from the employee’s pay. The IRS would assign a revenue officer who would investigate to determine the extent of the liability and who was responsible. The revenue officer would propose the trust fund assessments against the responsible owner and/or key employees.

In cases where the failure to account and pay over the payroll taxes was intentional, the IRS could pursue the case criminally. Criminal violations are referred to the Department of Justice (DOJ) for prosecution under either Section 7201, Section 7202, or both. The DOJ could also obtain court orders against recalcitrant owners to make sure they reported and deposited properly or would be shutdown.

The IRS has now upped the ante for employers who fall behind.

Starting last month, the IRS has announced that its revenue officers will now be tracing where the unpaid payroll tax money actually went during their “trust fund investigation.” If it is determined that money went either to the owner or was spent for the owner’s benefit, the owner will now be facing a double whammy of the unpaid income taxes on those funds. If it is determined that a business owner pocketed payroll tax remittances to maintain a luxury lifestyle, it will more likely lead to prosecution.

Furthermore, where the payroll tax money was not paid to the government, but was instead used for the owner’s benefit, revenue officers are instructed to pull the owner’s 1040 income tax returns to see if the money that benefited them was reported as income. If the money was not reported as income on such personal tax return, the revenue officer could submit the returns and investigation records to the civil audit division for assessment of the tax and 75% civil fraud penalty, or refer the case to the IRS Criminal Investigation Division to review for criminal prosecution for unreported income.

In this new environment, a seemingly routine payroll tax debt, a civil obligation, may be a criminal tax nightmare in waiting. Therefore, the old way of dealing with payroll tax debt has suddenly become inadequate. Pre-emptive investigations must be undertaken to determine whether the unpaid funds were used by the owner. If so, a pre-emptive amendment filing may be in order before the IRS comes calling.

If you have or have been notified by the IRS that you may have payroll tax liabilities, contact experienced tax attorneys at the Thorgood Law Firm. Tax debts do not get better with time. The later you address your tax debt, the more exposure you have and the less your options.