Are you yet to file your 2019 or 2020 tax returns, or did you already file them but late? Generally, the IRS imposes a late filing penalty on tax returns filed after the relevant deadline. This onerous penalty may add up…

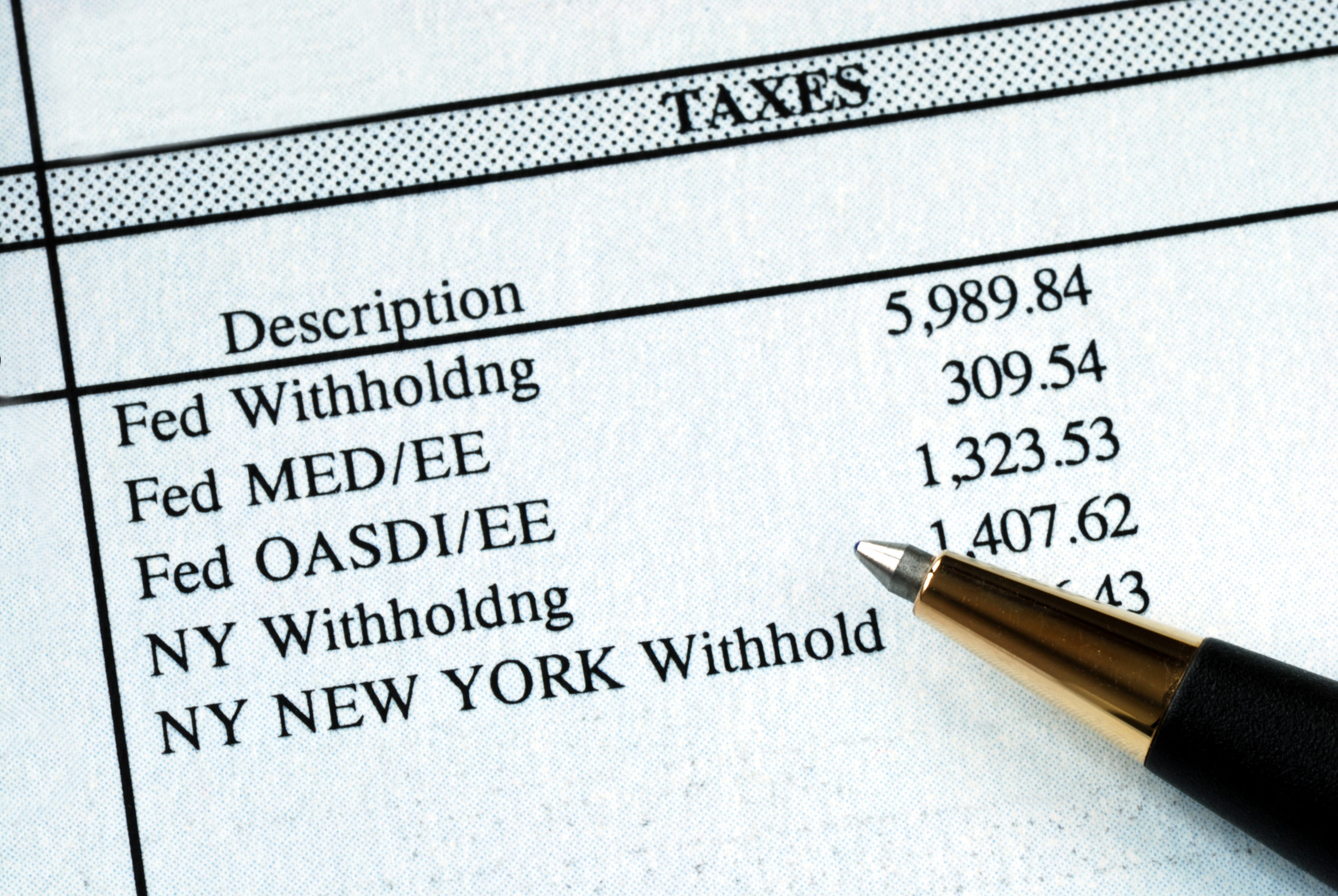

Fail to Remit Payroll Tax? Criminal Liabilities May Attach Normally, whenever an employer fails to pay over payroll taxes collected from its employees, the IRS will impose a hefty Trust Fund Recovery Penalty, which may equal the amount of the…

Treasury Department and IRS release final and proposed regs on the new 100% additional first-year depreciation deduction. . . On September 13, the Treasury Department and the Internal Revenue Service today released final regulations and additional proposed regulations under § 168(k) of the Internal…