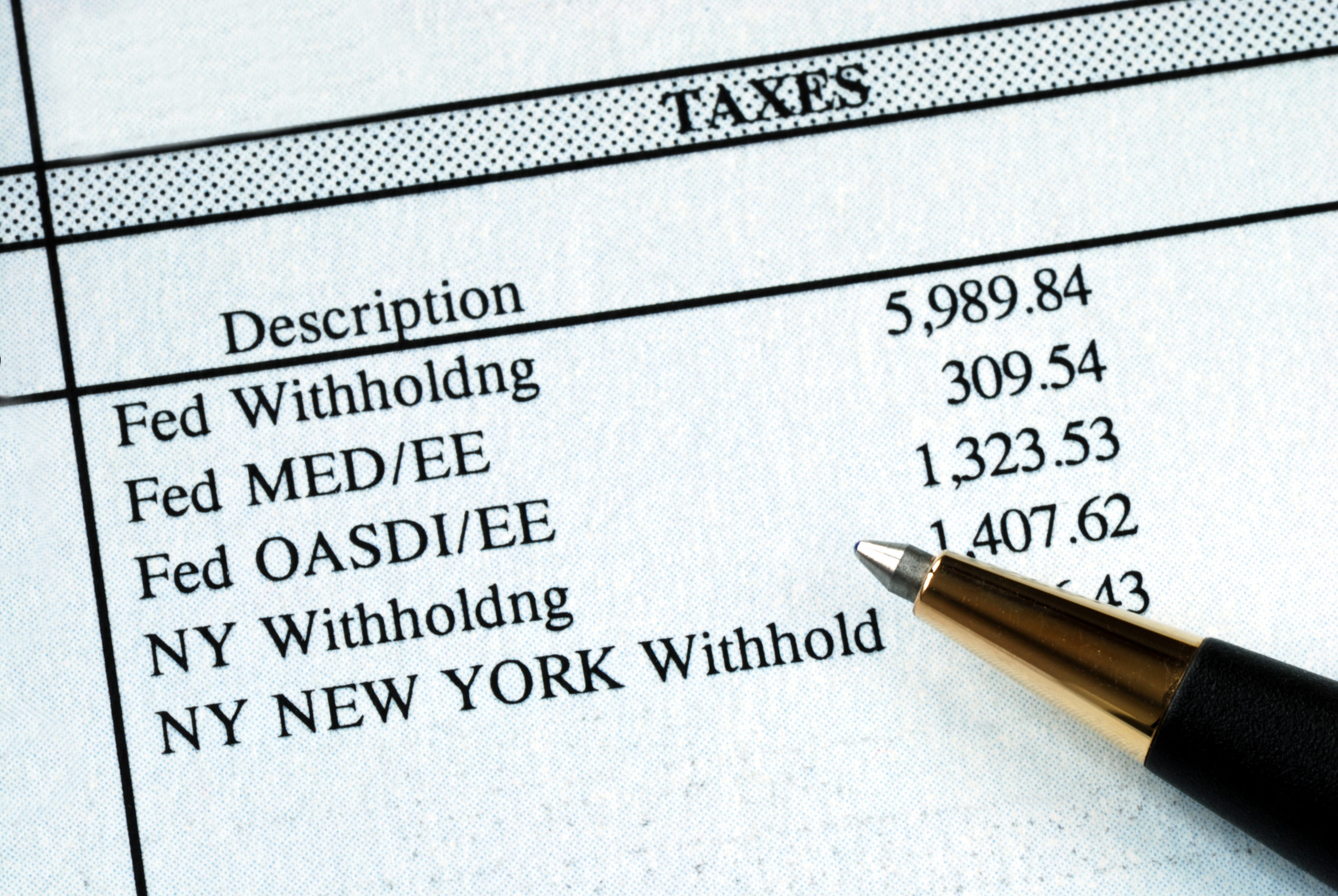

Yes, if your side gig qualifies as a genuine business (with a profit motive) and meets both federal and New York State rules for deducting losses. That means you must show that your expenses directly relate to an active, profit-seeking…

©2020, Thorgood Law Firm. All Rights Reserved. By: Pixemplary