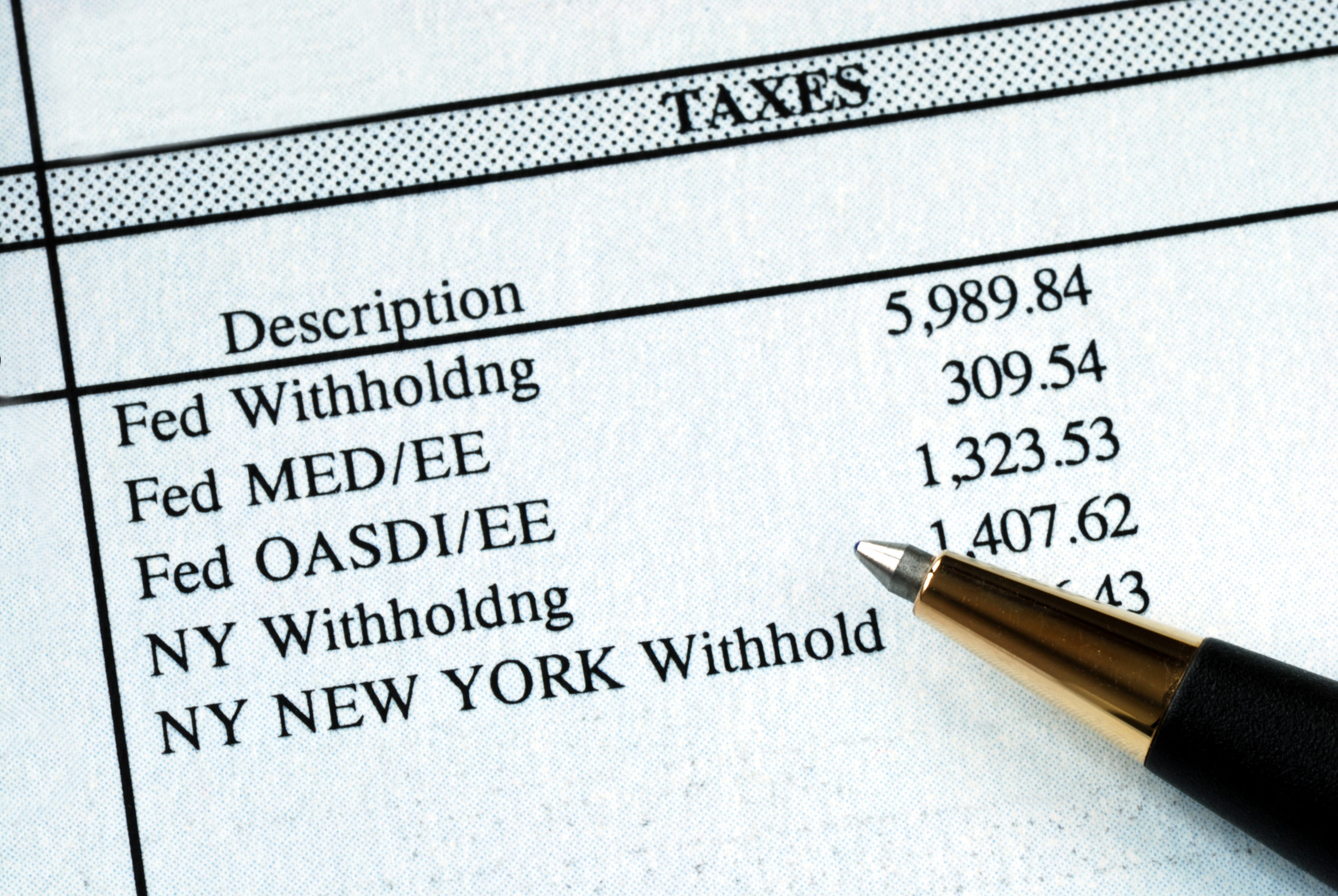

Fail to Remit Payroll Tax? Criminal Liabilities May Attach Normally, whenever an employer fails to pay over payroll taxes collected from its employees, the IRS will impose a hefty Trust Fund Recovery Penalty, which may equal the amount of the…

©2020, Thorgood Law Firm. All Rights Reserved. By: Pixemplary